MyFXspot.com is an independent macroeconomic consultancy with thousands of subscribers all over the world. We provide fundamental research to help our clients make better investing decisions. Our subscribers should expect to get access to:

1Trading ideas (entry, take profit, stop loss)

Forex: EURUSD, GBPUSD, USDJPY, USDCAD, AUDUSD, NZDUSD, EURGBP, EURJPY, EURCAD, GBPJPY, AUDNZD, AUDJPY

Precious metals: GOLD, SILVER

Stocks: S& P 500, DAX, SHANGHAI COMPOSITE

Commodities: WTI OIL

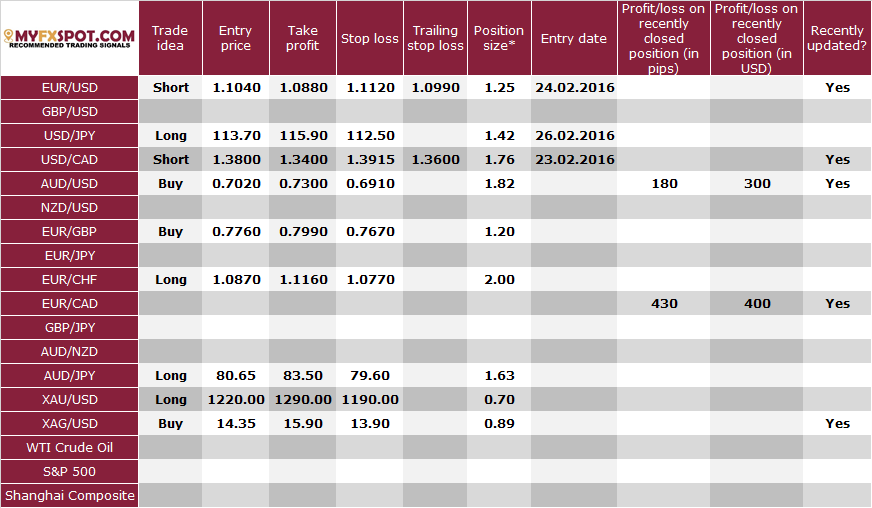

This is a sample publication:

* only forex and precious metals - position size suggested for a USD 10, 000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / 10, 000 USD) * (our position size). It is recommended to round the result down. For example, if the result was 2.671, your position size should be 2 mini lots.

2Investment Clock - great quantitative tool for investors

Different asset classes sectors tend to perform better than others at different phases of the economic cycle. We estimate current phase of the economic cycle and the Investment Clock shows which asset classes have historically outperformed in current phase of the economic cycle according to our research.

3Essential market news, technical and fundamental analysis, reviews of central bank decisions

We provide you regular commentaries on important economic and market issues and events, previews and forecasts of forthcoming data releases resulting from our knowledge, experience and quantitative tools.

4Last but not least

We describe fundamental factors, discuss recent changes in trends, resort to numerous quantitative tools and much more. You are able to take a close look at how we come to our conclusions and decide whether you share our current opinion regarding the market, but at the end of the day, it is you who decides what to do with your capital. That is why we strongly recommend you to conduct your own research and always rely on common sense – nobody knows what might work out for you just as you do.

iCry2Talk

iCry2Talk proposes a low-cost and non-invasive, intelligent interface between the infant and the parent that translates in real time the baby’s cry, displaying the result in a text, image, voice and sign language message.

Download the App!